Running your business is a lot of work. The last thing you want to worry about is a costly mistake from a payroll related misstep. In fact, 40% of small businesses get fined an average of $850 per year for improperly paying their payroll-related taxes so this is not a small concern.

At Gusto, we work with more than 25,000 small business owners like you on payroll, benefits, and workers’ comp. Here are some of the most common payroll mistakes a business owner can make.

1. You Forget to Pay Taxes Year-Round

For many first-time business owners, it’s common to think of business taxes like personal income taxes. In other words, I’ll pay my taxes at the end of the year (or in April!).

But did you know that you likely have to pay taxes year-round? The IRS and each state’s governing body regulate your tax payment schedule, and the schedule differs between each state. Also, the frequency of your tax payments also depends on your payroll frequency (e.g., monthly, biweekly).

One additional mistake is mismatching tax payments with your employees’ pay schedules. For example, if your business pays monthly payroll for most of your employees and semimonthly for others. Rather than pay taxes according to the employee’s pay period, you pay taxes monthly for everyone. Because you are not matching your taxes based on pay period, you may be at risk for tax penalties. To protect your business, outsource your payroll to a third-party provider or accountant.

2. You Misclassify your Employees and Contractors

2. You Misclassify your Employees and Contractors

You are starting your business and a friend helps out with some design work. At first, she comes and goes as she pleases, but your business picks up. Now she’s coming more regularly, and using the workspace you created for her and on a work computer. Is your friend an employee or contractor?

Misclassifying your worker can be a costly mistake on multiple fronts. If your contractor is actually an employee, you may be underpaying payroll taxes. On average, employees can cost 25-30% more than contractors.

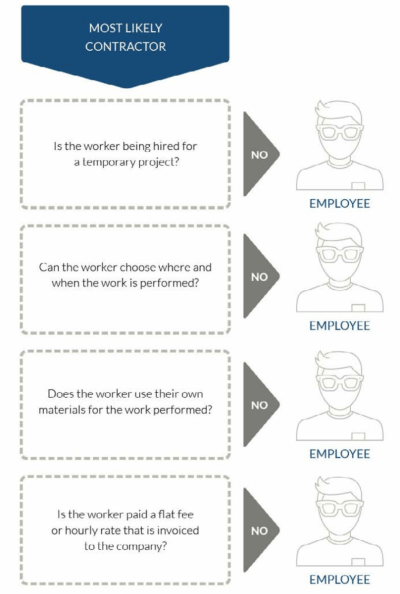

In additional, nearly 30% of employees are misclassified as contractors. The Department of Labor is cracking down on employers who are misclassifying employees as contractors. Use this handy checklist to see if your worker is an employee or contractor.

3. You Forgot to Keep Important Reports on File

Actually, good reporting can help you manage your business or help you avoid costly legal fines. For payroll, you are legally obligated to keep certain documents on file:

Form I-9: Each employee needs to fill out Form I-9 to verify he or she is legally eligible to work in the US. You don’t need to submit the form, but you must keep it on file (a digital copy works just fine) for the entirety of the employee’s employment, and a minimum of either 3 years from the hire date or 1 year from the term date, whichever is longer.

Optionally, you can choose to verify the employee’s work status online using e-Verify.

Form W-4: Your employee will also need to fill out Form W-4 to determine their tax withholding (Note: You cannot do this on their behalf). The W-4 does not need to be submitted anywhere, but each company is legally required to keep every employee’s W-4 on file for a minimum of four years.

Only modern payroll providers like Gusto manage your withholding taxes on behalf of you and your employee.

New hire reporting for states: Each state has a department to report your new hires. You will typically provide the employee’s name, address, and social security number. Depending on the state, you may have anywhere between a few days to 90 days to submit this information to the state. Check your local state tax, labor, and workforce website for more information. In California, for example, an employee has to file a DE-34. Fortunately, your payroll provider should be able to file documents like the DE-34 automatically on your behalf.

You’re busy running your business but a tax penalty can really sidetrack your business. For more information on this, take a look at our guide.