A business line of credit is not only one of the most popular financing options, it is also one of the most misunderstood. By reading this article you will come to understand exactly what a business line of credit is, the requirements, and if it is indeed the right solution for your startup.

As an entrepreneur, you will often face financial challenges. These can be either in the form of unexpected payments or in the form of planned expansions for your business. In both cases, you might find yourself in the position of needing to apply for business line of credit.

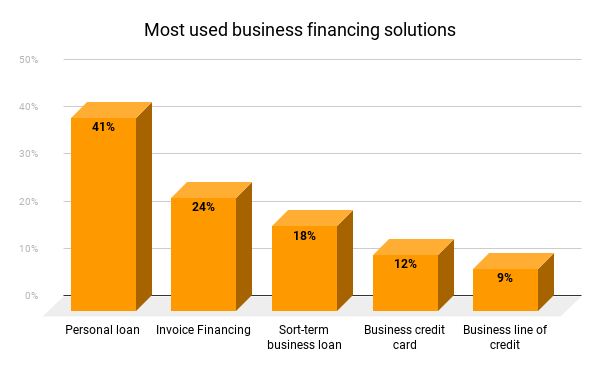

A study conducted in 2016 shows that although entrepreneurs have several business financing solutions at their disposal, most still opt for personal loans when they need a quick fix to their problem. Only 9% of business owners who answered the poll have opted for a business line of credit.

How it Works

A line of credit operates similarly to a normal credit card. You have a predetermined amount of money which you can use in however way you decide to. It’s a revolving line of credit that allows you to use the money, pay it back with interest at any time, and then use it again.

Obviously, there will be certain restrictions on what you can use the money for, based on the lender of your choosing. However, it is pretty clear that your spendings should be business oriented. Many small businesses opt for these lines of credit to overcome financial obstacles, such as upfront payments for a new supplier or unexpected corporate expenses.

Business Line of Credit Types

When it comes to these kinds of credits, there are two main categories: secured and unsecured lines. Secured lines use both personal or corporate collateral in order to secure the repayment of your loan. Should you default on payments, the lender can opt to foreclose your assets if it deems it necessary. On the other hand, unsecured lines do not rely on specific collateral in order to guarantee that you will pay back your loan. Instead, you personally guarantee for the line. However, opting for an unsecured line also allows the lender to sue you and your company in case you default. In other words, the line isn’t exactly unsecured and may also lead to the foreclosure of both your personal and corporate assets.

Requirements

Not every small business or startup can qualify for a business line of credit. Granted, it is easier to apply if your lender of choice is not a bank. Regardless, there are certain criteria that you and your company must meet in order to be able to access a loan. In short, you will need proof of cash flow, credit score, and collateral.

The documents required include but may not be limited to:

- Tax returns (both business and personal)

- Balance sheet

- Profit and loss statements

- Proof of credit score

- Bank statements

- Driver’s license

You should do your research beforehand and have all the required documents ready when you apply. This will further speed-up the process and you’ll be able to access your credit line faster.

Credit Line Covenants

Most, if not all, business lines of credit will have at least a couple of covenants set. These are additional conditions that your startup must comply with in order to be eligible to apply for the loan. Keep in mind that these covenants will vary from one lender to another. Some of the most common ones include:

- Minimum Net Worth – this is mainly a protection for the lender. If you company keeps a minimum net worth, the lender ensures that the value of the assets set up as collateral won’t drop too low, thus preventing the recovery of the funds.

- Liquidity Ratios – this second form of protection for the lender ensures that your company always has the ability to pay its debts. You might be required to comply to certain liquidity ratios, especially cash flow ratio, current ratio, and quick ratio.

- Monthly Certification – this process refers to your obligation to disclose the state of your inventory, assets, and accounts to your lender on a monthly basis.

Advantages and Disadvantages

No matter how big or small your business is, if you find yourself in the position of needing a line of credit, you have to know that it doesn’t only come with advantages. It has some important disadvantages as well.

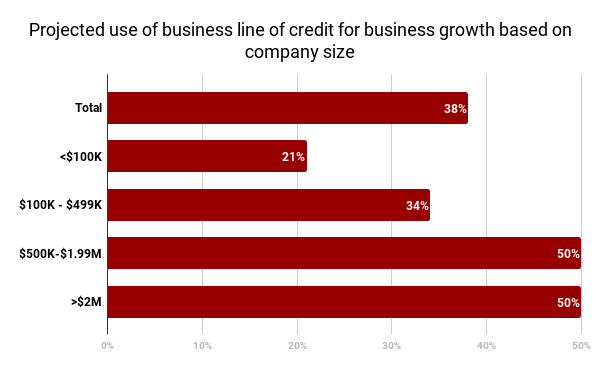

A recent study suggests that entrepreneurs are becoming more likely to opt for a business line of credit, especially when it comes to fulfilling plans that revolve around company growth. Although owners of smaller companies are less likely (21%) to opt for this type of credit line, once the company grows, owners are showing increased interest.

The main advantages are:

- Quick cash flow that you can use for virtually any business operating need

- Flexible payments with fixed interest, as long as you’re below the loan limit

- Very useful in case of financial emergencies

- Cheaper than other options

However, here are the main disadvantages:

- Harder to get than other loan options

- Trading history may be a requirement from some lenders

- Covenants could prove to be hard to comply with

- You can’t easily increase the limit of your credit line

As you can see, in some cases, the advantages will overcome the disadvantages. It’s up to you to decide if you’re willing to apply for a business line of credit for your startup. Even if you qualify for the requirements and you meet all the covenants, you must assess your needs and objectives before applying.

More often than not, your decision to apply for a line of credit will be influenced by the balance between cost and flexibility. While a business line of credit is often inexpensive, since you only pay interest for the amount of money that you use, it’s less flexible. Yes, you will be able to use the money for any business-related expenses, but it will be harder to increase the upper limit of your credit line.