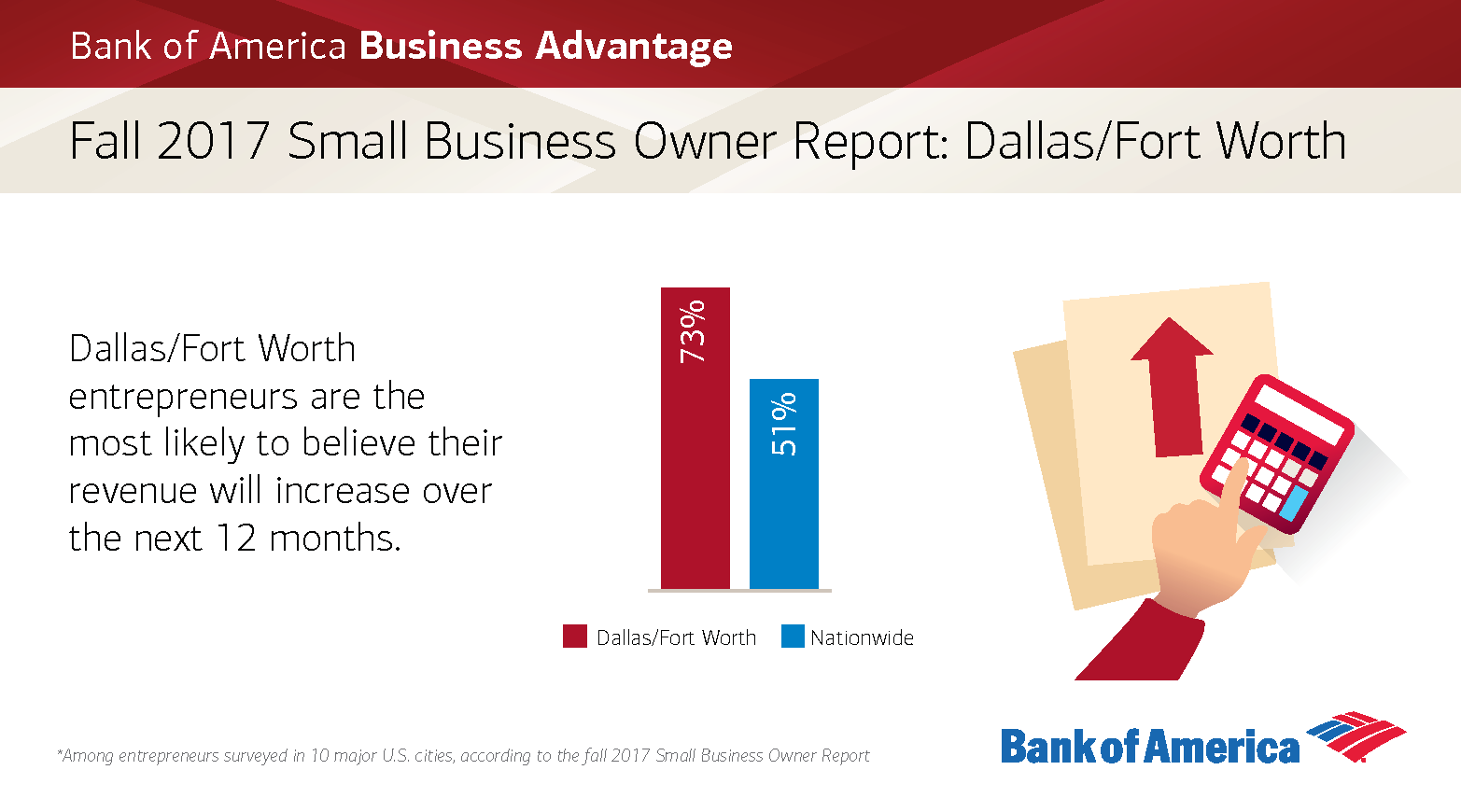

The core of the U.S. small business sector is solid, with many entrepreneurs expressing confidence that they will generate higher year-end revenues compared to 2016, and that the 2018 economy will improve. According to the fall 2017 Bank of America Business Advantage Small Business Owner Report, a semi-annual survey of 1,000 business owners across the country, nearly three-quarters of entrepreneurs are optimistic their 2017 year-end revenue will surpass 2016 revenue. Confidence in the economy also surged as nearly half of business owners expect their local economy and the national economy to improve in the year ahead (up 11 percentage points and 15 percentage points, respectively, from fall 2016).

The positive outlook on the economy bodes well for growth, as 92 percent of small business owners indicated that a positive economic environment is a critical factor to their ability to grow. Other growth factors include customer demand (93 percent), the ability to attract and retain quality employees (76 percent), favorable government policies (76 percent) and access to capital (63 percent).

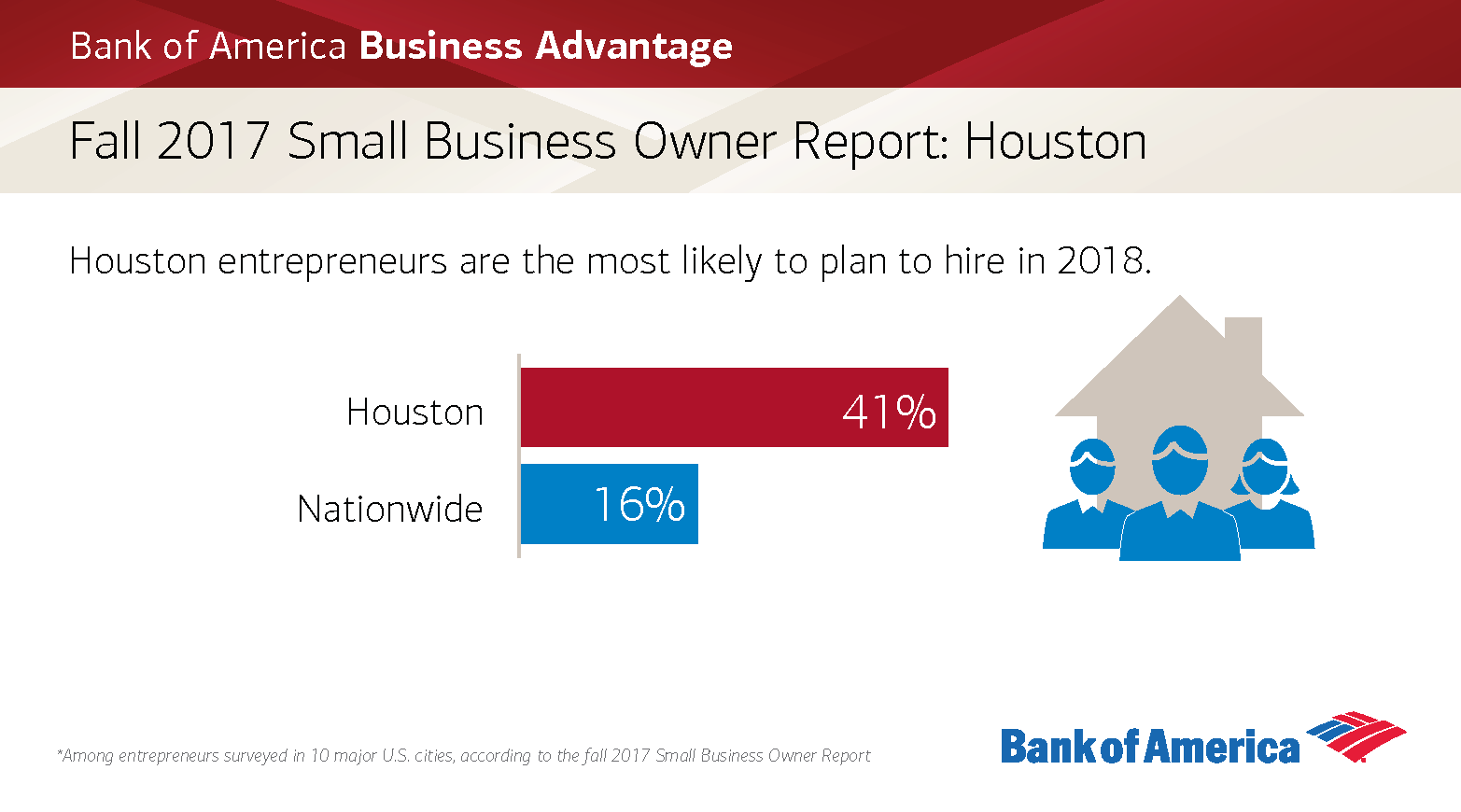

The report, however, also found that long-term growth plans remain unchanged from fall 2016, as 51 percent of small business owners plan to grow their business over the next five years. In addition, plans to hire are down year-over-year as 16 percent of entrepreneurs plan to hire more employees in the year ahead (vs. 25 percent in fall 2016).

“Entrepreneurs continue to be upbeat about future economic growth as they set their sights on 2018,” said Sharon Miller, head of small business, Bank of America. “Small business owners are optimistic about their ability to close the year strong and the outlook for the economy in the year ahead. However, these surges in small business owner confidence have not yet translated into plans for long-term growth.”

Rural business owners more confident about economy, urban counterparts more optimistic on revenue, growth and hiring

The report also revealed that entrepreneurs in urban areas have the most dynamic business outlooks and plans for growth, while their rural counterparts are more upbeat about the economy. Specifically:

- Fifty-seven percent of urban entrepreneurs plan to grow their business over the next five years (vs. 50 percent of their rural peers).

- Fifty-two percent of urban business owners are confident that their revenue will increase in the coming year (vs. 47 percent of rural entrepreneurs).

- Twenty percent of urban entrepreneurs plan to hire in 2018 (vs. 15 percent of rural business owners).

Conversely, rural entrepreneurs’ confidence in the national economy tops that of their urban counterparts. Fifty-one percent of rural business owners believe the national economy will improve over the next 12 months, compared to 45 percent of business owners in urban areas.

For urban and rural business owners, there are several areas where the level of economic concern varies widely based on location. Urban entrepreneurs are more concerned than their rural counterparts about the U.S. and/or global stock market (52 percent of urban vs. 33 percent of rural) and credit availability (36 percent of urban vs. 25 percent of rural). Meanwhile, rural business owners are more concerned than urban entrepreneurs about the strength of the U.S. dollar (60 percent of rural vs. 48 percent of urban), consumer spending (56 percent of rural vs. 40 percent of urban) and commodities prices (53 percent of rural vs. 45 percent of urban). Even with these differences, the cost of health care tops the list of economic concerns for both urban and rural business owners (70 percent and 72 percent are concerned, respectively).

A snapshot of small business owners across generations and genders

The report also revealed varying levels of business owners’ optimism and future expectations when cutting across generations and genders. Specifically, millennial entrepreneurs have a significantly more optimistic outlook in a number of areas, including:

- Eighty-one percent expect their revenue to increase in 2018 (30 percentage points higher than the national average).

- Forty-three percent plan to hire in the year ahead (27 percentage points higher than the national average).

- Seventy-six percent plan to grow over the next five years (25 percentage points higher than the national average).

- Sixty-three percent expect their local economy to improve within the next 12 months (15 percentage points higher than the national average).

Meanwhile, male business owners are more confident than their female counterparts that the national economy will improve in 2018 (51 percent of men vs. 40 percent of women), but women entrepreneurs are more likely to expect their revenue to increase in the year ahead (55 percent of women vs. 48 percent of men). When it comes to hiring, men and women entrepreneurs are on the same page, with 16 percent of both genders planning to hire in 2018.

Side-by-side demographic comparisons are available in the full report.

Face-to-face vs. virtual space

Surprisingly, fewer than half of entrepreneurs say social media and virtual communities are critical to many aspects of their business. Only 24 percent rely on social media for hiring, 37 percent use it to sell goods and services, and roughly two in five use social platforms to share updates with customers. Just 30 percent say social media has had a positive impact on their business’ bottom line in the past year. Instead, nearly three-quarters of business owners say they rely more on in-person interactions and networks for support running their business.

While social platforms aren’t seen as critical to small business success, digital tools that help businesses manage daily business operations are. Nearly three-quarters of entrepreneurs use at least one digital tool to run their business, with digital banking (46 percent) and financial tracking and/or accounting apps (34 percent) reported as the most popular tools.

Not all small business owners downplay the role of social media. Millennial entrepreneurs buck the national trend, reporting they are much more reliant on social media for sharing updates with their customers (74 percent), selling goods and services (66 percent) and hiring employees (56 percent). Forty-nine percent of millennials say social media has had a positive impact on their business’ bottom line in the past year, a full 19 percentage points higher than the national average. And, half of millennials primarily turn to virtual communities to connect with others about business matters. This generation is also the most likely to use digital tools—nine out of 10 use at least one for daily operations, and 49 percent of millennials use digital banking.

As hiring focus shifts, raises and rewards key to retention, while employee talent remains a key factor for growth

While plans to hire in the year ahead have cooled (16 percent in fall 2017 vs. 25 percent in fall 2016), entrepreneurs are focused on maintaining current staffing levels (76 percent in fall 2017 vs. 64 percent in fall 2016), and very few plan to downsize. Of those who are planning to hire in 2018, 70 percent plan to bring on full-time employees, and just over half plan to hire part-time staff. Fewer than one in five plans to hire freelancers, independent contractors, interns or seasonal employees.

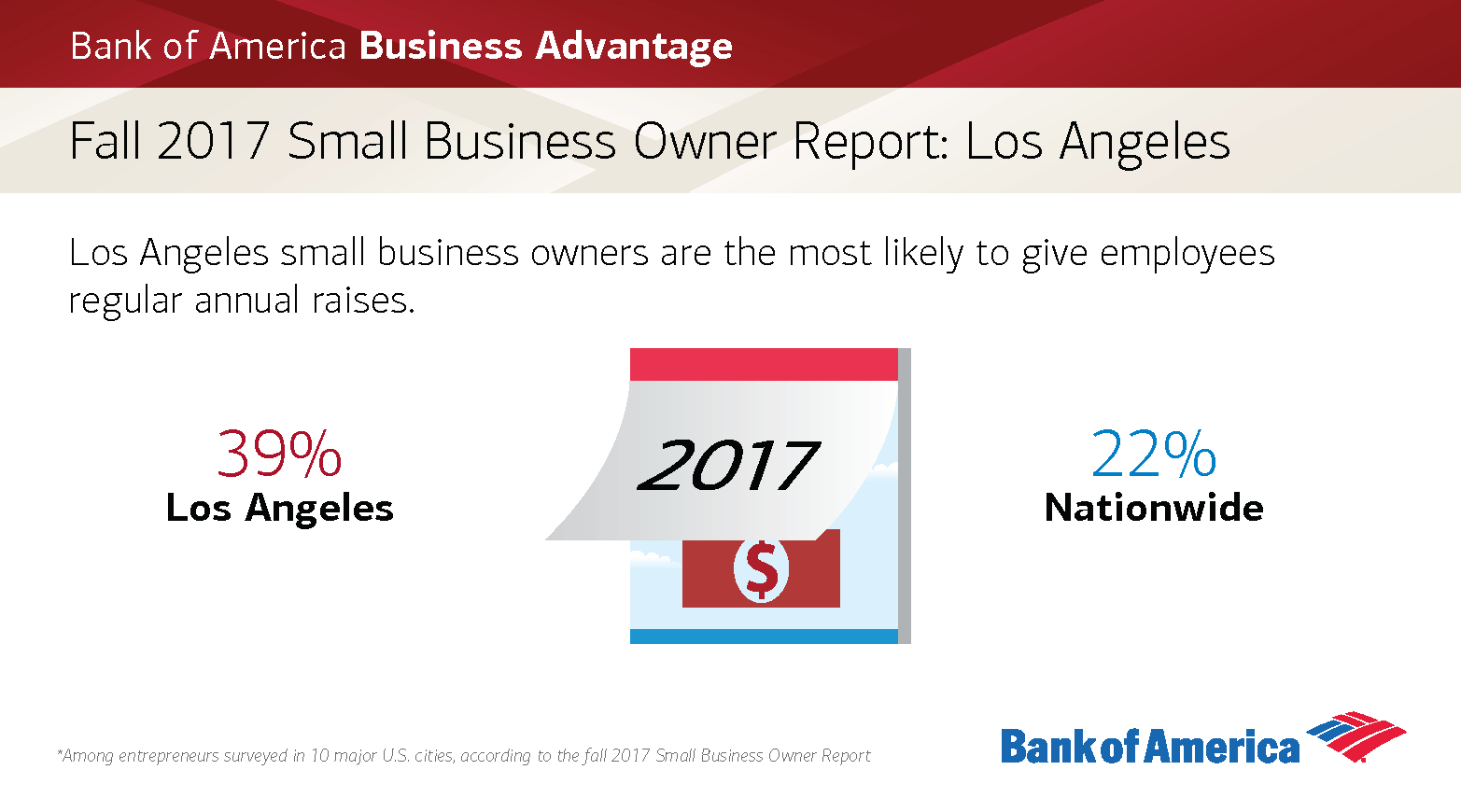

Small business owners continue to be thoughtful about retaining talent, with more than half taking steps within the past two years to do so, such as offering flexible hours or work locations (34 percent), providing perks such as office happy hours (17 percent) and giving spot bonuses or rewards (15 percent). Eighty-nine percent of entrepreneurs provide wage increases and promotions, with most raises given on an unscheduled basis (55 percent) driven by either employee performance or positive business growth. Meanwhile, 22 percent give raises every year, no matter what.

When asked about the top factors impacting business growth, more than three-quarters of business owners cited their ability to attract and retain quality employees.

For a complete, in-depth look at the insights of the nation’s small business owners, read the fall 2017 Bank of America Business Advantage Small Business Owner Report, and for additional insights, download the Small Business Owner Report infographic here.