Getting to Know the Payroll Tax Cut

The payroll tax cut was enacted in 2011, as a compromise to extend the Bush-era tax cuts. It was extended in early 2012, and again when that extension expired, and is currently set to expire at the end of the year.

Whether or not it will be renewed is a matter of current debate.

Small business owner with multiple employees? Your savings because of the payroll tax cuts may be substantial…

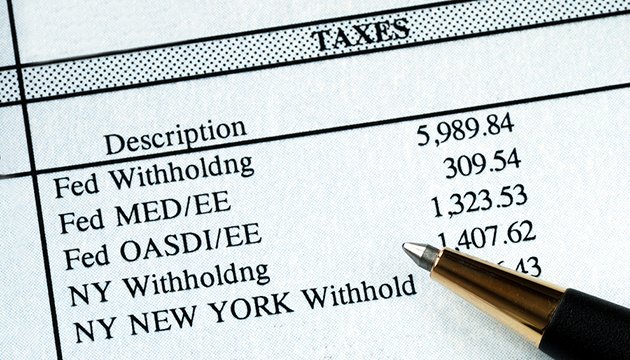

The payroll tax cut has had the effect of lowering social security taxes paid by small businesses on their first 5 million dollars in payroll. The previous tax rate was 6.2%. After the payroll tax cut, the rate was lowered to 3.1% The tax cut also lowered the rates paid by employees, to the same 3.1%.

The intention of these tax cuts was to stimulate a struggling economy, by simultaneously saving businesses money that could then be invested (in hiring, equipment, expansion, etc.) or spent, and by giving consumers more disposable income.

Pros and Cons

Critics are wary of extending the tax cuts, because they don’t believe they have enough of a stimulating effect on the economy. They have also expressed concern that the tax cuts are depleting social security funds, which are supposed to be replaced by money from the general fund.

However, naysayers see this as a risky maneuver, given the current economic climate.

Supporters of extending the tax cuts cite hard times for small businesses and consumers as reasons why they believe the tax cuts should be renewed. They believe that the stimulating effect that the cuts have on the economy, however small, is needed.

How It Applies to You

If your household income is around $50,000 per year, you’d save about $1,000 because of the cuts. True, that’s not a huge amount of money, but as we all know, every little bit helps.

If you’re self-employed, the tax cuts lower your self-employment tax liability, as well. Instead of paying 12.4% on the social security portion, you pay only 10.4%.

If you’re a small business owner with multiple employees, then your savings because of the payroll tax cuts may be substantial. Let’s say you have 5 employees who each earn $30,000 per year, for a total of 150,000 per year in payroll. At the previous rate of 6.2%, you would have paid $9,300.

Because of the tax cuts, you end up paying out $4,650. Obviously, the more you pay in payroll, the higher the stakes are for you.

Changes on the Horizon

The payroll tax cut expires at the end of 2012, and if it goes un-renewed, its expiration will result in one of the biggest tax hikes in US history.

The payroll tax cut was introduced as a temporary measure to stimulate a struggling economy, so you could call it the loss of a temporary cut, rather than a tax increase. But without alternate tax reductions to compensate, the end result will be the same: higher taxes. There is plenty of debate on Capitol Hill as to where exactly those alternate reductions will come from, but nothing is certain as of yet.

Stay tuned for updates on the payroll tax cut, here on The Self-Employed.